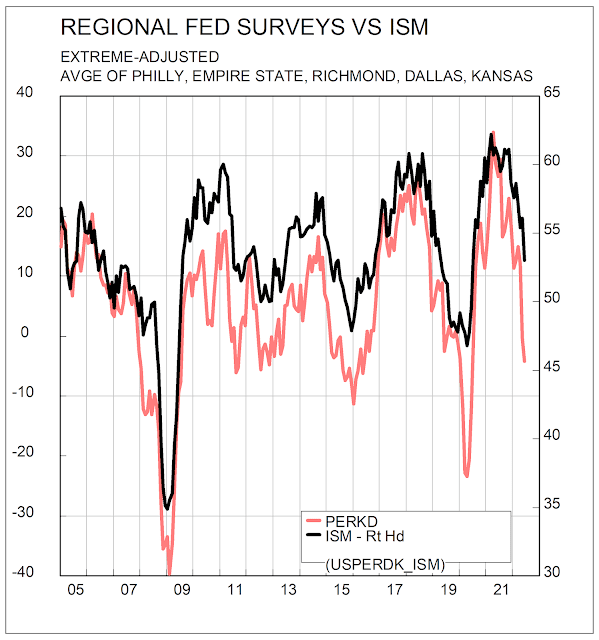

The July ISM survey won't be out until Monday. But it correlates very well with the average of the five regional Federal Reserve's surveys, as you can see in the chart below. The fit isn't perfect, but it's very close. So I expect a further decline in the ISM for July.

Will sustained falls in the ISM, Fed surveys, and the PMI survey lead to the Fed stopping its pattern of increasing the Fed Funds rate? I doubt it. It hasn't in the past! The Fed will want to see other confirmatory data, for example, rising unemployment rates, falling employment, falling retail sales.

Will Russia's invasion of Ukraine, and the likely European recession, stop the Fed from raising rates? Well, it might. But it might equally encourage them to keep on upping rates. Wars are associated with high inflation. This isn't (yet!) a war where the USA is waging a total war as it was in WW2, where the Fed keep the Fed Funds rate low and massaged the bond market to ensure long rates didn't rise either.

The problem is that the economy responds with a lag to changes in interest rates, and inflation with an even longer lag. Of course, the Fed knows this. But it got "behind the curve", waiting too long before it raised interest rates after the economy rebounded from the Covid Crash. Their fear will be that inflation expectations get embedded into the economy, making it much harder to keep inflation low.

The balance of probabilities is that they will raise the Fed Funds rate at least twice more.

No comments:

Post a Comment