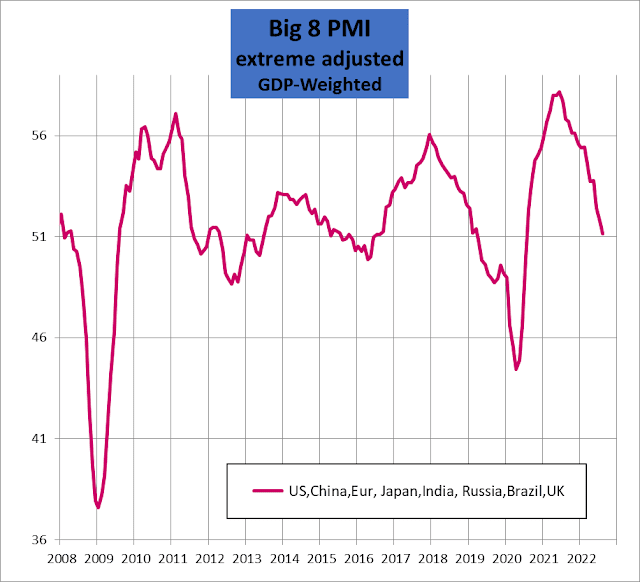

This is the GDP-weighted average PMI of the big 8 economies (US, Europe, China, UK, Japan, Brazil, Russia, India, each individually extreme-adjusted, mostly to reduce the Covid crash spike). When it falls through 50%, it will indicate the beginning of a global recession. The deeper it falls through that 50% "recession line", the deeper the recession.

As I've said before, it seems plausible that the world could experience a recession as deep as the GFC (2008/2009). The Fed is still raising rates, as is the UK. Europe is heading into an energy recession because of the shortage of gas; Brazil's central bank has been tightening rates for months; China is struggling with a property crash and strict covid lockdowns; Russia's about to suffer from a falling oil price, while the European gas price has peaked; India and Japan have no home-grown recessions, but will have to contend with the global downturn.

Commodity prices have risen as fast as they did at the first oil crisis in 1972/73 and that price rise led to the deepest post-war recession (until then), with a re-run in 79/80 when Volcker took more inflation out of the system by taking the Fed Funds rate to 18%. Powell is determined to deflate the US in one go, and conscious of the mistakes made in 75, will prolly keep rates too high for too long.

No comments:

Post a Comment