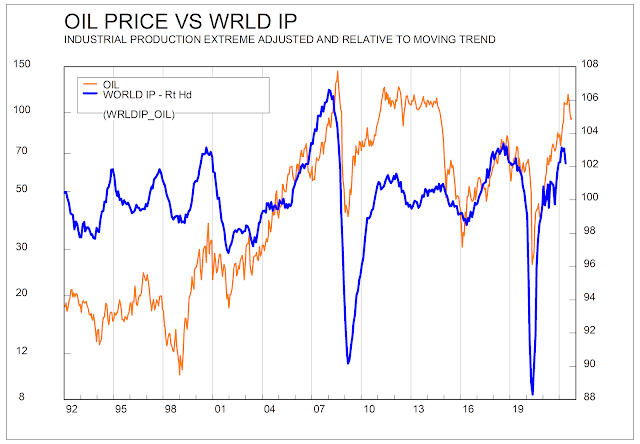

I wrote about the link between the oil price and economic growth here. Since then, we've had a couple of months more data, and the peak in the oil price is now clear. Industrial production has prolly also peaked, though the latest month's decline is partly due to lockdown in China.

|

| Source: my calculation of world IP |

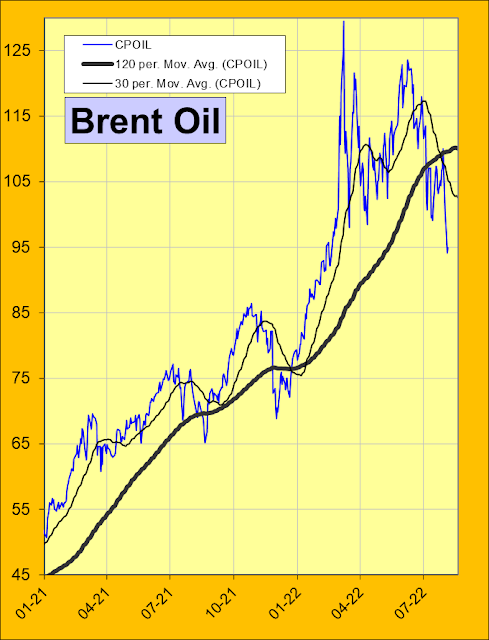

When technical analysis based on charts and economic fundamentals give similar indications, then you have a very strong signal.

Note in the chart below how the price of oil rallied back to the short-term moving average, but was unable to break through back into a rising trend. In addition, each peak was lower than the previous one. The short-term moving average has broken through the long-term moving average on the downside. This is called a 'death cross' and is a sign of an impending slide on the price. In addition, the long-term moving average has also started to fall. When the long-term moving average is falling, and the price is below it and also declining, this is a strong indication of a cyclical (as opposed to a short-term trading) bear market.

The geopolitical implications are also clear. Fossil fuels make up most of Russia's exports. Already the price of oil Russia receives is much lower than the global oil price, and the gap between the two is much wider than usual. Russia's "friends", China and India, are driving hard bargains. Russia is a relatively high-cost oil producer. A sustained fall in the price it receives for its oil will drive it and its oil companies into bankruptcy, stopping the war. At the same time, the Eu has committed to cutting its gas usage by 15%, which will mean the demand for Russian gas will fall by a much larger percentage.

|

| Source: Trading Economics |

No comments:

Post a Comment